PayTech.dk

Powering Future of Payment

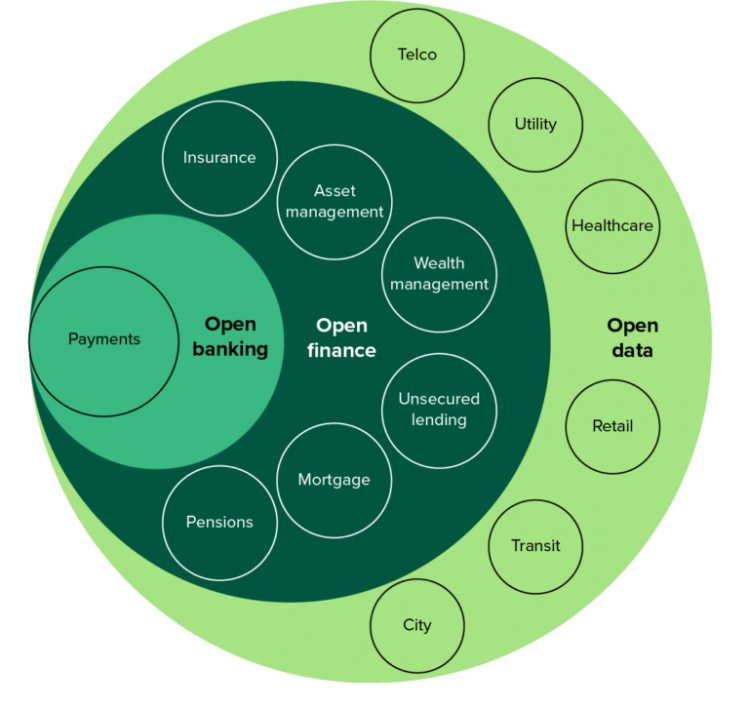

New regulations, PSD2 and Open Banking initiatives are enabling booming Paytech industry.

As the intersection of payment and technology, Paytech is at the center of this transformation. Paytech includes the Internet of Things, cryptocurrencies, contactless transactions and eWallet transfers.

Paytech is an industry that is considered a subsection of Fintech, that focuses on transactions and payments rather than finance as a whole.

Payments has been used as an exchange of money. However, as people switch to mobile and digital payments, the payment experience is being completely reinvented, which means effecting customer experience. Payments has been turned into a branding opportunity rather than just a simple transaction.

There is a big opportunity with mobile and digital payments to use innovation and technology to rethink the customer experience. Globalization, cross border payments play an even larger role than before. Convenient payment methods changing the way people interact with money.

PayTech Industry Players

- Electronic Money Institutions, EMI

- Card network

- Acquiring and issuing bank

- Payment gateways

- Payment Service Providers, PSP

Payments Regulation and Compliance

- SWIFT:2017

- GDPR: 2018

- AML: 2018

- PSD2: 2018, 2019

Payments Regulation and Compliance

- Omnichannel experience

- IoT

- Blockchain technology

- P2P payments

- Personalized solutions using Data